The changes have actually left the economy more deeply in debt than ever before. The only change is that the overseas debt is “private” rather than held by the government under a controlled currency and exchange rate system. But in the end working people will be paying the bill.

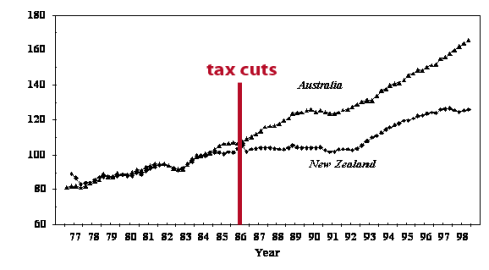

This question is dealt with very well in the CTU Alternative Economic Strategy which explained that the reforms were “unsuccessful even in neoliberal terms”. In terms of national output per person (GDP per capita) “New Zealand has steadily fallen further behind in its OECD rankings”. (See Graph 10)

Graph 10

The CTU paper does note one “success” – attracting foreign investment. New Zealand “now has one of the highest concentrations of foreign direct investment (investment where control of the company is intended) in the developed world, equivalent in 2008 to 42 percent of GDP compared to an average of 25 percent in the other developed economies and the world as a whole. …. But the direct investment into New Zealand has been of low quality, usually in the form of takeovers rather than new ‘greenfield’ investment introducing new technology and creating employment.”

In the decade 1986 to 96 almost half of the foreign direct investment was associated with the sale of privatized state assets. From the late 1990s it has been associated with Private Equity and investment company buyouts “with many of them quickly resold in highly indebted conditions.” Even the cheerleaders of foreign investment in the Treasury felt compelled to acknowledge in a 2008 paper that “some analysts argue that New Zealand receives substantial foreign direct investment inflows but has yet to benefit from spillovers [of expertise and new technology

into the rest of the economy]”

The CTU paper also notes that “Another part of the overseas investment has been the exceptionally high levels of international debt. The cost of paying the dividends and interest on those debt and equity investment liabilities has given us one of the highest current account deficits in the OECD…..About one dollar in five from exports of goods and services goes on servicing liabilities: the financial debt alone ($256 billion at March 2009) would take four and a half years to pay off. Bank debt accounts for over 70 percent of the international debt, and has been used largely to finance mortgages, contributing to the property price bubble of recent years and encouraging excessive investment in property compared to productive investment by firms. Related to this, and a direct result of the opening of capital markets is the exchange rate which is chronically over-valued as far as the balance of trade is concerned, burning off exporters through both the high value of the New Zealand dollar and its volatility. The dollar – the 11th most traded currency in the world in April 2007 according to the Bank of International Settlements – is largely driven by international capital movements rather than the ‘real economy’ of goods and services trade.”

The end result is that New Zealand now has a much larger overseas debt and servicing costs than existed before the economic “reforms”. The economy has also suffered from the decimation of manufacturing and other productive sectors to be replaced by low wage service jobs.

New Zealand Herald columnist Brian Fallow pointed to the dangers of the high debt in a column on April 1, 2010:

We are up to our chins in debt to the rest of the world and this, the International Monetary Fund warns, remains a key area of vulnerability for the economy.

Net foreign liabilities at the end of 2009 were $167 billion, equivalent to 90 per cent of the economy’s output last year.

The increase in the external debt mirrors a big increase in household debt – a legacy of the last boom.

Whether a wariness of debt will be an enduring legacy of the recession that followed remains to be seen.

Right now, at least, households are decidedly debt-averse and businesses even more so.

Reserve Bank data out on Tuesday showed business sector debt in February was nearly 8 per cent lower than a year earlier.

Households, which find it harder to shed debt than businesses do, had increased their debt levels by just 2.7 per cent over the year ended February, and the annual increase has been no higher than that at any stage in the past year. Consumer debt is down 4 per cent on a year ago.

All this is despite the fact that interest rates are at cyclical lows.

ANZ says the effective mortgage rate – the average rate people are paying on their home loans – is 6.7 per cent, down from 8.8 per cent at the peak in September 2008.

Floating mortgage rates are around 5.85 per cent, compared with an average 8.2 per cent since 1999.

BNZ estimates debt servicing costs are running below 10 per cent of household disposable income, from a high of nearly 14 per cent two years ago. (If this looks low, remember most households have either paid off the mortgage or are renting).

Enjoy it while it lasts. The Reserve Bank expects to start raising the official cash rate “around the middle of the year”.

It does not expect it will have to push it as high in this cycle as it did in the last one – an eye-watering 8.25 per cent. But the reasons for that carry little joy for borrowers.

One is that wholesale interest rates now incorporate a much wider risk margin than in the lax years before the crisis. This is expected to persist.

It means a higher cost of funds for the banks, and higher lending rates for borrowers, for any given level of the OCR.

The other factor is that the wholesale yield curve is positive again – that is, longer-term interest rates are higher than short-term ones. As deputy governor Grant Spencer put it last week, “borrowers have nowhere to hide”.

Borrowers have piled into floating rates or short-term fixed ones, so a higher OCR will bite harder and sooner.

By contrast, during the boom borrowers could effectively dodge, or at least delay, the impact of ever-higher official cash rates by taking cheaper longer-term fixed-rate mortgages.

This imparted what Governor Alan Bollard called a “sponginess” to the monetary policy brakes to the extent that he had to just about stand on the brake pedal for years, with serious spillover effects on the productive sectors of the economy, before it had the desired impact in the mortgage belt.

A key factor in avoiding another destructive housing boom, of the kind which seems to be emerging across the Tasman, is whether people’s expectations of house-price inflation (or capital gains as we prefer to think of it) come down.

They ought to. It is fantasy to imagine double-digit annual rises in house prices can be sustained indefinitely when the incomes out of which mortgages and rents are paid increase much more slowly than that.

The effective real interest rates that apply in the housing market are nominal mortgage rates deflated not by the consumers price index but by expected house-price inflation. The higher the latter is, the more attractive any given nominal mortgage rate is.

So more realistic expectations of house-price rises should mean monetary policy does not have to work as hard, and less pressure on the cost of capital for businesses.

Right now sentiment in the housing market is on the grim side. Having more people out of work than at any time in the past 16 years does not help, but perhaps the bigger factor is nervousness and uncertainty about tax change in next month’s Budget.

The changes are expected to reduce both the incentive for people to shelter taxable income in rental property investments and the ease with which they can do so.

How much and for how long that weighs on house prices generally remains to be seen.

Meanwhile, business borrowing is likely to recover with the economy.

After contracting for five straight quarters, business investment in plant and machinery rose in the December 2009 quarter with imports of capital goods.

They need to. Much of the productivity and income gap with Australia is explained by capital shallowness – significantly lower levels of physical capital employed per worker.

What then of the third component of national savings, the Government?

Next month’s Budget might paint a slightly rosier picture, but the half-year fiscal update delivered last December projected another six years of fiscal deficits, pushing the Government’s net debt from just 6 per cent of GDP in 2008 to 30 per cent in 2016 before it starts trending town again.

On its own that is not a scary number. Net debt was that high as recently as 1998 and 30 per cent is downright modest compared with where many advanced economies’ governments are heading.

But it cannot be looked at in isolation and when set alongside the parlous state of the external accounts it does not present a reassuring picture.

Net external debt of 90 per cent of GDP is conspicuously high by international standards. We have got away with it so far in part because almost all of it is private-sector obligations, much of it held by the banks and backed by vanilla mortgages.

But with the Government having switched from saving to debt accumulation, and with household savings rates still negative, the increase in Crown debt will have to be funded by foreign savers.

Competition for their funds will be fierce, from larger governments with bigger deficits to finance and higher credit ratings, and increasingly from corporate borrowers as the world recovery gathers momentum.

Bond yields are bound to rise and the combination of mounting debt and higher interest rates will pre-empt a growing share of future tax revenues.

The current account deficit is a measure of the extent to which national savings fall short of funding investment spending within the economy. For 2009 it was $5.5 billion or 2.9 per cent of GDP, or 3.8 per cent if you ignore the impact of Australian-owned banks losing a tax case.

That could well be as small as it gets. The IMF expects it to be back at 8 per cent of GDP by 2015, heaping ever more debt on the mountainous – nay, alpine – pile already there.

(Part of a series of extracts from “Exposing Right Wing Lies” by Mike Treen, Unite National Director)